The Financial Bubble: How Stock Market Frenzy Is Impacting India’s Economic Balance (2014–2023)

India’s economy over the past decade has been characterized by robust government expenditure, surging stock markets, and stagnating private consumption. From 2014 to 2023, the market capitalization of listed companies on Indian exchanges grew by 259.1%, while private consumption—India’s largest GDP component—grew only by 51.4%. During the same period, bank deposit growth slowed significantly, as retail investors increasingly diverted funds to the stock market in search of higher returns. This article evaluates how government expenditure and excess liquidity are indirectly being funneled into equity markets, creating a risky financial bubble that threatens long-term economic stability.

Government Expenditure and Its Indirect Link to Stock Markets

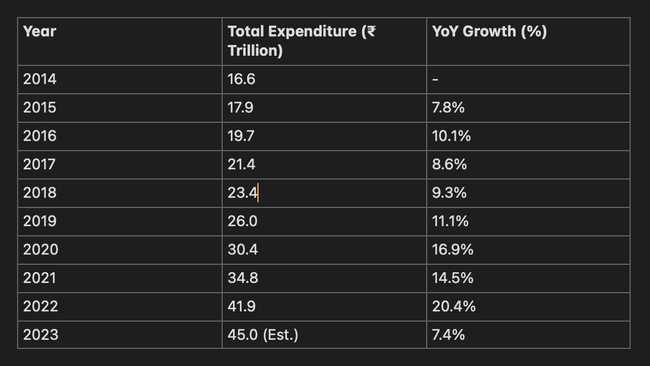

Government expenditure grew significantly from ₹16.6 trillion in 2014 to an estimated ₹45.0 trillion in 2023, driven by infrastructure investments, fiscal stimulus, and large-scale disinvestments. However, a portion of this liquidity has bypassed the real economy and found its way into financial markets.

Key Drivers Linking Government Spending to Stock Markets

- Disinvestment Proceeds: Government disinvestment programs raised ₹2.7 trillion between 2014 and 2023, much of which boosted the equity market. For example, the LIC IPO (2022) and stakes in PSUs were absorbed by institutional and retail investors, adding to market momentum.

- Liquidity Injection: Post-2016 demonetization and subsequent fiscal stimuli provided excess liquidity, which investors reallocated into equities.

Government Expenditure Growth (2014–2023)

Source: Union Budget, Ministry of Finance, GoI

Rising Market Capitalization vs. Private Consumption Growth

While government spending boosted financial assets, its effect on private consumption—a more critical growth driver—has been muted.

Diverging Trends in Market Capitalization and Consumption

- Stock Market Boom: From ₹75.3 trillion in 2014, India’s market capitalization surged to ₹271.4 trillion in 2023, fueled by institutional inflows, retail participation, and speculative investments.

- Consumption Stagnation: In contrast, private consumption grew at a subdued pace, from ₹106 trillion in 2014 to ₹160.5 trillion in 2023, indicating weak demand in the broader economy.

Cumulative Growth Comparison (2014–2023)

Source: NSE, MOSPI

Conclusion from Data

- The sharp rise in market capitalization is driven more by speculative inflows than real earnings growth or economic output.

- Consumption’s tepid growth reflects insufficient job creation, stagnant wages, and wealth concentration in financial markets.

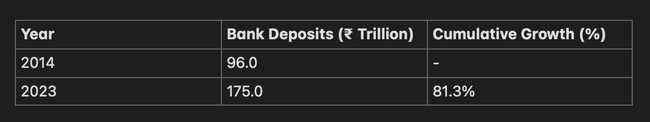

Declining Bank Deposits Amid Market Frenzy

The sharp rise in stock market participation has come at the expense of bank deposits. With real deposit rates falling, investors are increasingly chasing equity-linked returns, reducing the banking system’s ability to fund long-term credit needs.

Bank Deposit Growth (2014–2023)

Source: RBI Annual Reports

Deposit growth has significantly lagged behind the stock market, raising concerns about the sustainability of credit growth in the banking system.

The Role of Domestic Institutional and Retail Investors

Domestic Institutional Investors (DIIs) and retail investors have played a pivotal role in driving stock market valuations, leveraging lower interest rates and excess liquidity.

Equity Investment Trends

Source: NSE, SEBI

Retail Involvement: Platforms like Zerodha and Paytm Money have democratized equity participation, encouraging speculative investments.

The Risks of Stock Market Frenzy

Wealth Concentration

The stock market boom has disproportionately benefited the wealthy, exacerbating income inequality. According to Oxfam’s 2023 report, the richest 1% of Indians own 40% of national wealth.

Speculative Bubble Risks

Valuations in certain sectors have reached unsustainable levels, risking a financial correction that could destabilize investor confidence and consumption further.

Insufficient Job Creation

High market capitalization growth has not translated into commensurate job creation, as companies prioritize capital efficiency over expansion.

Policy Recommendations

- Reallocate Expenditure: Direct more government spending toward rural welfare, job creation, and demand-driven schemes.

- Improve Financial Literacy: Curb speculative retail investments by ensuring investors are aware of risks.

- Revive Banking: Encourage higher deposit rates to improve banking liquidity and credit capacity.

Conclusion

India’s market frenzy, driven by liquidity and speculative inflows, presents systemic risks that policymakers must address. Without aligning financial market growth with consumption and employment, the economy may face a potential bubble that threatens long-term stability.

Hold on for the next part…